25 May 2018, Zurich – Thaler.One is launching a blockchain real estate platform, offering institutional and private investors the combination of high-grade European real estate investment with the liquidity, flexibility and low transaction costs of the blockchain.

This represents the democratisation of investing into real estate, a proven high-performing asset class worth $220 trillion globally, as funds, private family offices and individuals can create a balanced portfolio of assets without the need to buy whole properties.

Thaler.One has the scalability to accommodate over $10 billion in assets and has already attracted high interest from institutional investors with aggregate assets under management (AUM) exceeding Euro 76 bn.

Thaler.One operates upon stringent fund governance standards and is EU-licensed, with an SEC-compliant token placement. By incorporating this level of governance from the outset, Thaler.One creates an institutional grade platform for investors keen to explore the advantages that blockchain technology has to offer.

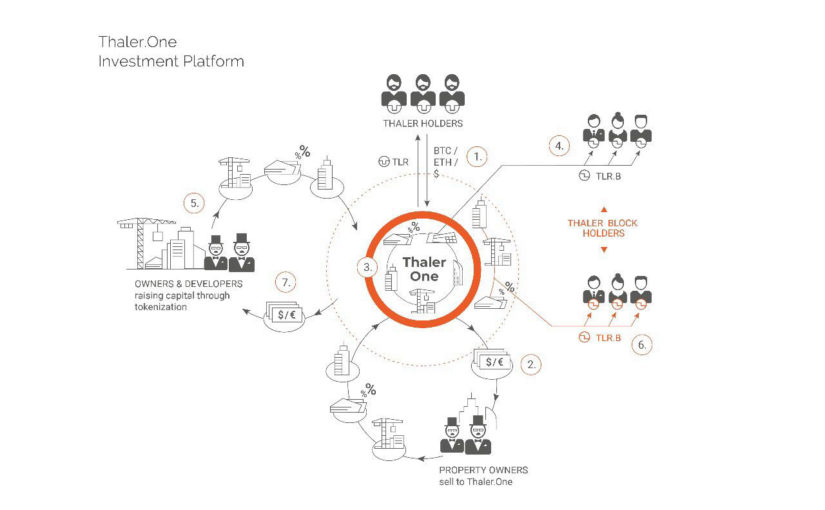

The Thaler.One platform consists of two parts:

- The Thaler Fund – with digital units (Thaler Tokens) representing Fund units. The proceeds from the sale of Thaler Tokens are used to acquire real estate assets for the Fund’s portfolio.

- The Thaler MarketPlace – where digital units (ThalerBlock tokens) will be issued for every real estate asset listed on the MarketPlace, allowing smaller investors to build real estate portfolios of their desired return and risk profile.

Early investors with the Thaler Fund will receive a return higher than that of traditional real estate, due to the rental yields from the Thaler Fund portfolio combined with income from the MarketPlace operations.

Investors in ThalerBlock tokens on the Thaler MarketPlace will be given the power of choice in selecting their own diversified real estate portfolio. Seasoned cryptominers can lock in their profits by linking them to different physical real estate assets, which each pay ongoing yields.

All investors will be able to buy and sell Thalers across the Thaler MarketPlace and, later, select crypto exchanges, providing the liquidity and low transaction costs not traditionally available in real estate.

Thaler.One was founded by experienced real estate individuals who have previously worked at Morgan Stanley, Cushman Wakefield and EY, with advisors from Credit Suisse, JLL and the Crypto Valley Association, Switzerland.

Unlike other crypto market participants, Thaler.One is a clearly defined security token offering, with the company adhering in all aspects to the regulatory framework required to make it legally compliant.

A full breakdown of Thaler.One’s legal structure, as well as a demonstration of how investor funds are used, is included as standard by the company.

Will Andrich, Co-founder and CEO of Thaler.One, commented:

“Our vision is to transform and democratise real estate investing. Thanks to the governance standards instilled within our offering, we are already seeing initial interest from institutional real estate investors, family offices and seasoned crypto miners. Our blockchain based approach offers confidence and security, which investors appreciate, as well as additional rewards to early supporters.

Our income model means that we need very low leverage on our assets – typically only 30-40% Loan to Value (LTV), so we can generate an overall higher income, which is then passed to our investors.”

ENDS

For more information, visit: http://thaler.one/

Media enquiries

Yellow Jersey

Adam Wurf: adam@yellowjerseypr.com

Georgina Whittle: georgina@yellowjerseypr.com

About Thaler.One

Thaler.One is a new generation real estate investment vehicle which combines an EU-licensed fund with a crowdfunding marketplace, incorporating blockchain-based technologies to fundamentally improve investor access and control.

It is transforming real estate investing by offering investors access to core European real estate with the management experience, network and governance of institutional real estate, alongside blockchain based technologies to give investors greater control and flexibility with lower costs.

The Thaler.One advisory board comprises some of the world’s most successful real estate and blockchain investors, including Michael Lange (Managing Partner at ACG, Former Chairman of the Board at JLL), Mattia Rattaggi (Swiss Crypto Valley Association, former UBS Group executive), and Saydam Salaheddin (Head of EMEA Real Estate, Credit Suisse).

Announced today, Kuwait Finance House has joined RippleNet, a move which will enable the bank to provide cross-border payments using Ripples blockchain technology.

Announced today, Kuwait Finance House has joined RippleNet, a move which will enable the bank to provide cross-border payments using Ripples blockchain technology.