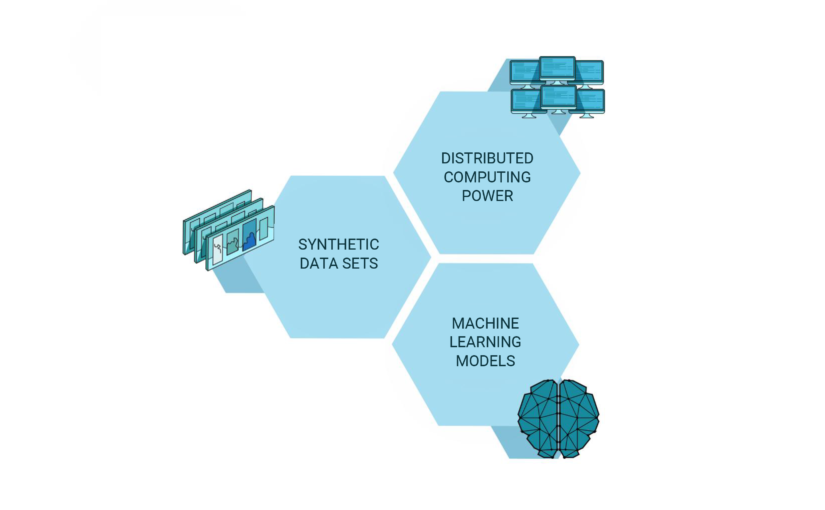

The Abyss is a digital distribution platform which aims to revitalize the growing video game industry by providing gamers and developers with earnings incentives and a platform that will boost community growth.

Developers have become focused too much on sales. Tons of marketing expenditures are necessary to get a product out there. And this process has started to impact the actual game development cycle. Developers are starting to increasingly compete with each other over marketing reach rather than the actual product.

The platform provides developers with a load of analytical tools that can be used to study their target audience, maximize sales, and decrease marketing expenses. User statistics tools and info about ARPU, MAU, ROI, LTV, and others will be readily available.

Developers can also utilize the platform’s internal CPA Network for traffic driving purposes. The network will provide game developers with the option to purchase and sell quality traffic for different games as well as to promote projects using platform advertisements, banner ads, and user newsletters.

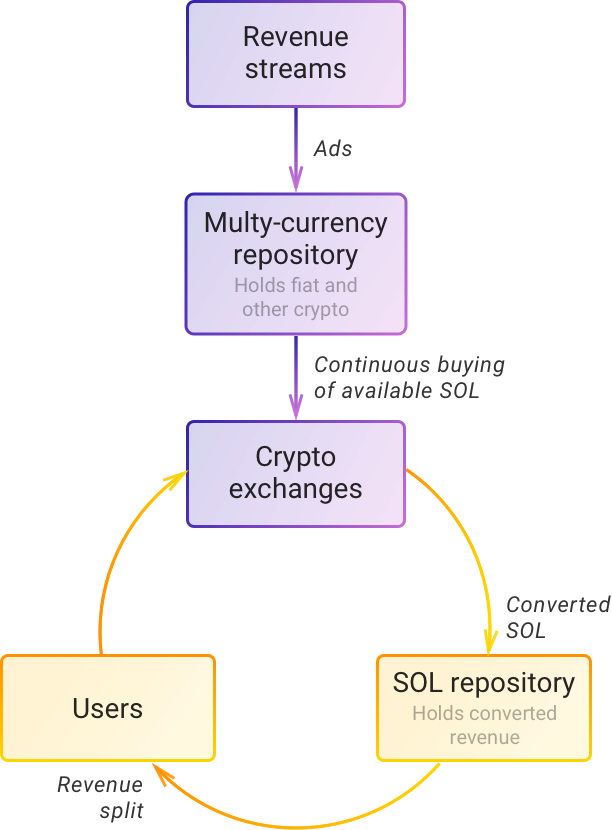

The Abyss also uses a motivational referral and reward system for players and developers.

The referral system is split into five levels. A third of The Abyss platform income will be allocated to the referral program: the first level will receive 40%, the third and second – 20%, fourth and fifth – 10% from the allocated sum

Game Developer Platform Benefits

Game developers will be provided with a plethora of tools that they can utilize to earn greater profits while marketing their projects, and keeping costs low. Additionally, the platform supports bi-currencies. Meaning that developers can earn ABYSS tokens and fiat currencies for their work too.

The platform also allows developers to carry out crowdfunding campaigns in order to bring their projects to their final state. Beta and Alpha versions of games can also be launched, with analytical and support services available all day. Free promos are also available, such as homepage ads and banners.

Platform Gamer Benefits

Players will be able to earn rewards for the referrals and their activities on the platform. In-game auction will also be available, through which gamers can boost their ROI. Players can also join syndicates (Masternodes) and earn even more profits by playing together.

The platforms UI and client are also flexible and loaded with features, like screenshotting, video recording, frequent performance updates, LAN support, and a wide scope of client settings for convenience purposes.

Growth And Demand Of ABYSS Tokens

ABYSS tokens will be needed for in-game transactions and transfers as well as to take advantage of the platforms functional tools. Such as the internal CPA Network for marketing purposes, motivational reward and referral system. The Abyss also supports bi-currencies, meaning that transactions can be made in fiats and ABYSS tokens. ABYSS tokens are needed to support most of the platform’s functionality. Thus, demand will be on a constant rise in proportion to the platform’s growth.

The Abyss Token Sale

The Abyss Pre-Sale is set to start on the 29th of November, 2017, and continue until the 1st of December, 2017. The minimum buy-in price during the Pre-Sale is 5 ETH, early birds will also receive a 25% bonus. Tokens will be available at 2500 ABYSS = 1 ETH. BTC is also accepted.

The main Token Sale will start on the 12th of December and go on until the 24th of January, 2018.The minimum entry price for the main Token Sale will be 0,1 ETH. With bonuses provided as follows:

1st Sale day +15% (tokens)

2-4 Sale Days +10% (tokens)

5-20 Sale Days +5% (tokens)

Additionally, players who participate in both Pre-Sale or main Token Sale will enjoy a lifetime increased income from payments made by their referrals.

PRE-SALE

Every payment from:

5 ETH will provide +50% for the 1st referral level (“my friends”)

25 ETH will provide +50% for all other referral levels (“friends of my friends” etc.)

TOKEN SALE

Every payment from:

20 ETH will provide +50% for the 1st referral level

100 ETH will provide +50% for all other referral levels

A code will need to be provided to and used by players to activate and claim this bonus during the registration process. Be careful though, as the code can only be used once, and then it becomes tied to the designated e-mail address for good.

To find out more about the project, visit The Abyss official website:

https://www.theabyss.com

Read their Whitepaper: https://www.theabyss.com/static/docs/theabyss-whitepaper-en.pdf

Or e-mail The Abyss team: [email protected]

27 November 2017, Zug, Switzerland, trade.io has announced the launch of its partnership with

27 November 2017, Zug, Switzerland, trade.io has announced the launch of its partnership with  Sola

Sola