The Swiss Blockchain Hackathon, led by six of Switzerland’s leading blockchain and ICT institutions, took place over the weekend at Zurich’s Trust Square blockchain hub. The three-day event was attended by over 200 participants from almost 20 different countries around the world. The organizers presented hackathon participants with real-world challenges in diverse verticals, with help from major corporations, top-tier academic institutions, and Amazon Web Services.

The Swiss Blockchain Hackathon took place from 21 to 23 June and had over 200 hackers in 41 teams from around the world. The event was jointly hosted and organized by Trust Square, CV Labs, Crypto Valley Association, Swiss Blockchain Federation, Bitcoin Association Switzerland, and Swiss ICT. The participating hackers solved real-life challenges in six different verticals: eGovernment, Agriculture & Food, Mobility, Finance, Supply Chain, and Intelligent Parcel.

At the opening ceremony Carmen Walker Späh, President of the Government Council of the Canton of Zurich, stated “Personally, I am convinced that blockchain has what it takes to become the next big development step of digitalization,” and she continued “Together with partners from politics, industry and academia, I am committed to creating legal certainty, favorable general conditions and a broadly supported ecosystem. So that Zurich and Switzerland can maintain the positions of internationally competitive blockchain locations.“

The hackers each had a chance to win multiple, exciting prizes, equaling up to more than CHF 200,000. Hackers won everything from crypto bags filled with essentials for anyone interested in blockchain technology to the big Entrepreneurial Prize, where one team won the chance to fast track their startup idea at the CVLabs Incubator. The submitted projects where so convincing that the jury decided to bring two projects in front of the audience for the final decision – it remained a draw and it was decided to split the CHF 25,000 main prize between the two projects from Team Axelra and Team Blockbyte. The list of every winner is on the next page.

The teams worked diligently throughout the Swiss Blockchain Hackathon, staying up until the early hours of the morning working on the challenges presented to them in their verticals. Coaches were on-site throughout the event to help the teams with any hard-pressed issues they faced. The vertical coaches, volunteers from partner organizations were there to help each team out about their concerns in the contents of each vertical. Platform coaches represented technical partners like Amazon Web Services to help each team out with any technical question or need.

Overall, The Swiss Blockchain Hackathon was a great success and the event showcased the vast talent within the local and worldwide blockchain community thanks to the vigorous work from each single participant.

You can see pictures and videos of the first Swiss Blockchain Hackathon at http://hackathon.trustsquare.ch

Crypto Valley Week Media Roundtable

Marc Degen, co-initiator of the #SBHACK19 will be present at the Crypto Valley Week Media Roundtable on 25 June 2019, from 12.00-13.30hrs at the Casino in Zug.

*********************

Winner Overview:

Agriculture & Food:

Co-Overall winner: Team Blockbyte led by Mike Schälchli, for the Lend-it solution, where you can offer and lease land in trusted way.

Mobility:

Co-Overall winner: Team Axelra led by Severin Wullschleger, for #velove, an app that awards crypto currency rewards for biking to work and reducing your personal CO2 offset.

eGovernment:

Team ETH led by Burak Seyid, for Petizio, an app that lets you safely create and sign petitions.

Finance:

Team Kuznyechik led by Anton Permenev, with their project on crowd valuation of assets that have no financial history!

Supply Chain:

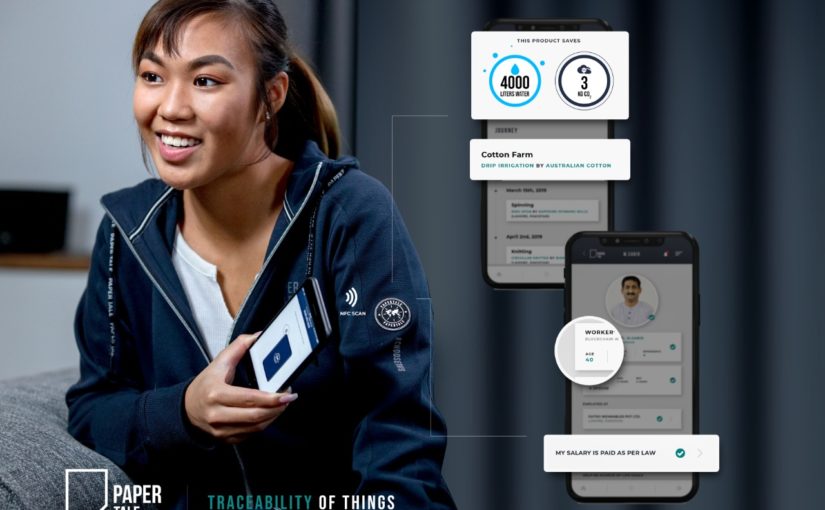

Team Elastonians led by Adem Bilican, for peer-to-peer traceability solution.

Intelligent Parcel:

Team OSB led by Joao Aguiam, for the close range package delivery service Padely.

AWS Special Prizes

1st: Agrofood led by Oliver Gaede (Agriculture & Food)

2nd: Orvium led Antonio Romero Marin (Intelligent Parcel)

3rd: Traceauth led by Trevor Oakley (Intelligent Parcel)

Swiss Blockchain Hackathon At A Glance

Date: 21 – 23 June 2019

Location: Trust Square, Bahnhofstrasse 3, 8001 Zurich, Switzerland, and surrounding locations

Total Countries: 19

Austria, Egypt. Estonia. France, Germany, India, Israel, Liechtenstein, Poland, Portugal, Russia, South Africa, Spain, Switzerland, Tunisia, UAE, UK, Ukraine, USA

Teams: 41

Hackers: 203

Verticals: 6

Coaches: 57

Slack Messages: 6211

Organizing partners

Trust Square, Bitcoin Association Switzerland, CV Labs, Crypto Valley Association, Swiss Blockchain Federation, Swiss ICT

Vertical partners

Accenture, Agroscope, Canton of Zurich, Die Post, SDX, ZVV

Platform and Service partners

Amazon Web Services, Amanox Solutions, Blockfactory, Cardano, PwC, Andibefree, Avado, Tecflower, certification, bitConsultant, Froriep, Felfel, Intellica, Tezos, Shift, Kilt

Academic partners

Universität Basel, Universität St. Gallen, Universität Zürich, HSR Hochschule für Technik

Rapperswil, Frankfurt School Blockchain Center, Hochschule Luzern, ETH Zurich, b2lab at ETH Zurich, ZHAW School of Management and Law

Supporting partners

ARC, Blocksport, Cargolux, Dezentrum, GS1, i.AM, Mobility, Modum, MS Direct, Procivis, Panalpina, Q_Perior, Proxeus, Smart Containers, Sigma Ledger, Sygnum, Verum Capital, Smiling Gecko, myclimate, Lipton, Pepsi Max, Orangina, Webtiser

Media and Communication partners

MoneyToday, Farner, BerChain, SICTIC, Mama, SWI