There seems to be a sudden surge of ICOs in the gambling space, and Zero Edge has caught our attention. It aims to create a cryptocurrency for the online gambling space and they have an ICO coming up. Zero Edge is a decentralized online casino and an open protocol which aims to offer players 0% house edge casino games, fee-less sports betting and an open source platform for building online games.

Zero Edge will be creating their own token named Zerocoin which is the fundamental part of their business model. Adrian Casey, CEO of ZeroEdge, says, “The Zero Edge Casino model is based on Metcalfe’s law and factual Bitcoin price growth. Casino players, i.e. Zerocoin holders will not only be able to play 0% house edge games, which offer a truly equal odds of winning against the house but will also see their Zerocoin value increase as a result of increased demand and adoption of the token.”

The blockchain use case for Zero Edge is mainly in providing decentralised trust. All games will be publicly verifiable on the Ethereum blockchain without negative effects on user experience during the game session. Furthermore, Zero Edge Casino will have a sophisticated and audited random number generator (RGN) mechanism to ensure complete randomness of its games.

The need

Adrian Casey, the CEO of Zero Edge believes that The main problem with online gambling industry today is that its purely profit-driven enterprise with marginal consideration for consequences of its practices.

He says, “The simple solution to the problem is creating a platform where playing games is “free”. Players are not required to pay any fixed amount of money to be able to play at the casino. This can only be achieved by creating a closed loop economy with its own token where players purchase the token with fiat or crypto. Since the supply of ZERO is limited, its value is directly proportional to demand.”

They claim that their main difference that makes Zero Edge stand out from its competitors is that its business model is based on its token’s value growth rather than the cash flow generated from casino’s games.

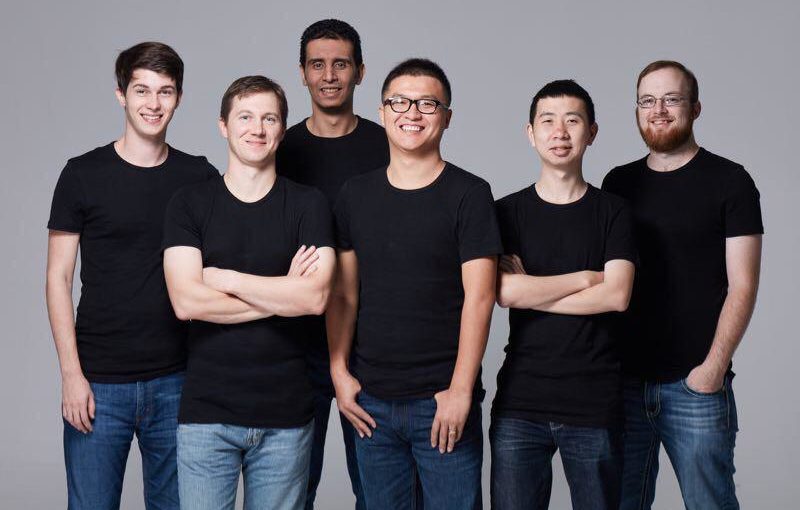

The Team and product

The team at Zero Edge is lead by a CEO who has spent 6 years with two of the biggest names in the betting industry, namely William Hill and Centrebet. Adrian is supplemented with a good tech and marketing team, many of whom have had past experiences in the betting industry.

The advisory team is dominated by legal experts, professionals in the betting industry and other entrepreneurs in the blockchain and cryptocurrency space. A good thing to note here is that there isn’t anyone mainstream big name on the team and advisors, but preliminary LinkedIn verification shows a very focused emphasis on the betting industry.

As far as the product goes, you can check out some of the games in the casino section on their website, with some other verticals such as sports betting, are still under construction.

Our Take

An interesting fact I came across recently was that gambling has been part of human life even before written history. The earliest six-sided dice date to about 3000 BC in Mesopotamia. This has translated to a huge betting industry in today’s day and age, where the global online gambling market was 37.91 billion USD in 2015 and is estimated to reach 59.79 billion USD by 2020, at a CAGR of 9.5%

Zero Edge ticks all the boxes when it comes to the market size, the problem it is solving, the team and product. The fact that they have a working product is particularly reassuring. There’s also a good incentive for early investors. The company will organize its early token sale (pre-ICO) in February when the public will be offered to purchase a limited supply of Zerocoins for a discounted price.

Join their Telegram Channel – https://t.me/zeroedgecasino

Visit Zero Edge – https://tokensale.zeroedge.bet

Eligma

Eligma