The term “Artificial Intelligence” was coined by American cognitive scientist John McCarthy back in 1955, initiating the whole discussion on simulated cognitive processes in machines. After the Dartmouth conference of 1956, AI became a legitimate new field of knowledge, sparking interest of intellectuals all over the world – it quickly gained its advocates (scientists John McCarty, Marvin Minsky, Allen Newell among others) and naysayers (philosopher John Searle and his famous “Chinese Room” thought experiment). Yet outside of these learned circles, the general public for years to come associated AI more with science fiction than actual science – and movies like Stanley Kubrick’s “2001: Space Odyssey”, with its inscrutable and menacing AI antagonist HAL9000 helped cement this notion.

Things are very different today when AI has finally become part of our everyday lives. Predicting its future applications is now an almost mundane process. Artificial Intelligence is poised to excel in fields dealing with excessive amounts of data and a need for identifying patterns in data flows (curiously enough, ability to identify patterns is the key metric in IQ – our measurement system for human intellect). This is the reason why AI is already widely used in finance and why its role in this sector will continue to grow. AI applications in modern finance could be divided into the following categories:

Customer Service. Millennial customers value direct communication and quick replies. Small companies and startups like Zichain have been able to provide this through extensive social media presence, but large multinationals with outsourced call centers have been struggling to provide an adequate solution. Enter chat bots – an AI-based solution that has taken the banking industry by storm – and long telephone calls to ask a simple question are already a thing of the past. We believe this trend will continue as advances in AI and machine learning will allow chat bots to answer ever more complicated queries, potentially making the idea of a call center redundant in the course of the next decade.

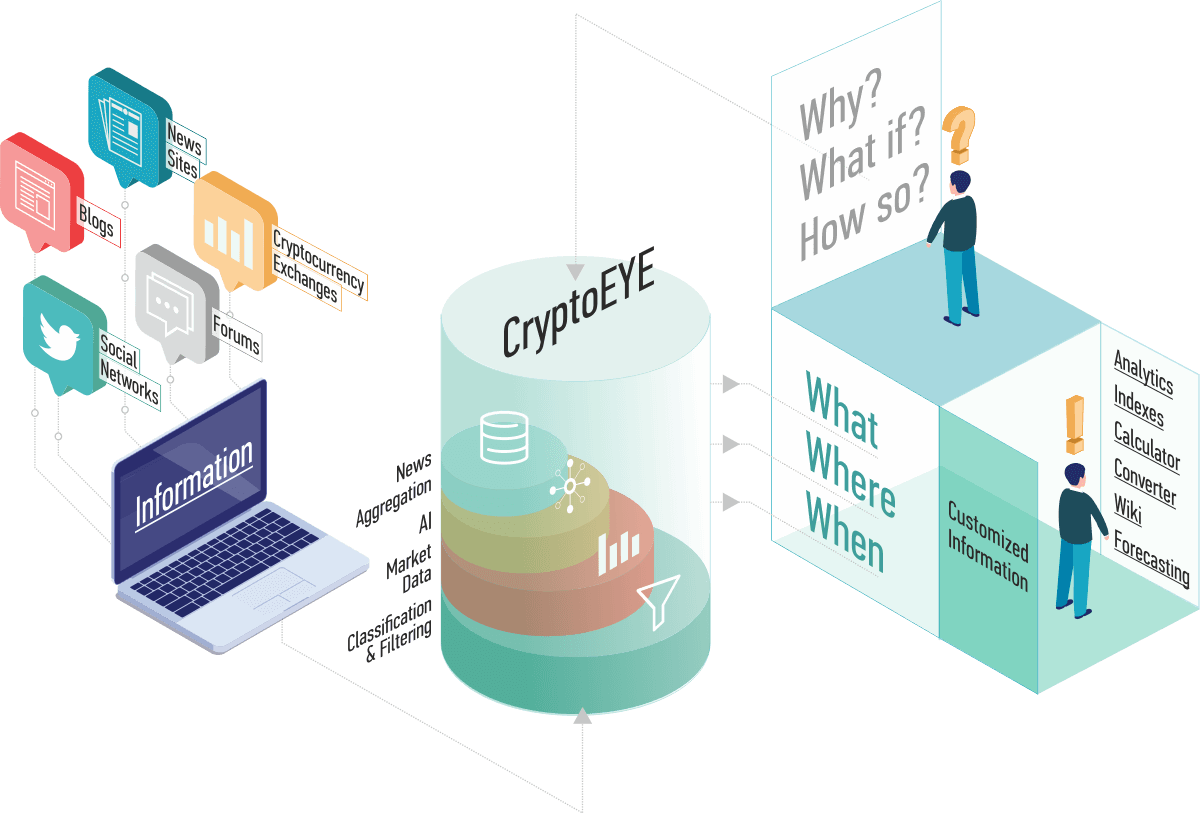

Market Analysis Tools. AI technology and machine learning can also be used to scan data flows in real time, quickly analyse a huge amount of data and then filter it according to a complex set of criteria. As futuristic as it sounds, this technology is already integrated into our analytical platform – CryptoEYE. It is designed to be your primary source of information about cryptocurrency markets: online price quotations for 1200+ digital assets, graphs for proprietary Zichain indices, a comprehensive CryptoWiki database of coins and tokens with all the essential metrics and a customizable news feed. This last module utilizes our groundbreaking AI and Big Data technology to scan the web for information and present it to you in the form of a news feed that is tailored for your needs and interests and prioritizes news pertinent to your investment portfolio and trading strategy.This way you are never going to miss an important event or market signal.

Financial Advisory. Artificial intelligence is capable of using a bunch of parameters (your investment goals, risk appetite, existing portfolio, etc.) to provide you with ideas for potential investments that you may want to consider. The service of a financial advisor that used to be available only to the rich clients of Wealth Management offices would now be offered to all market participants.

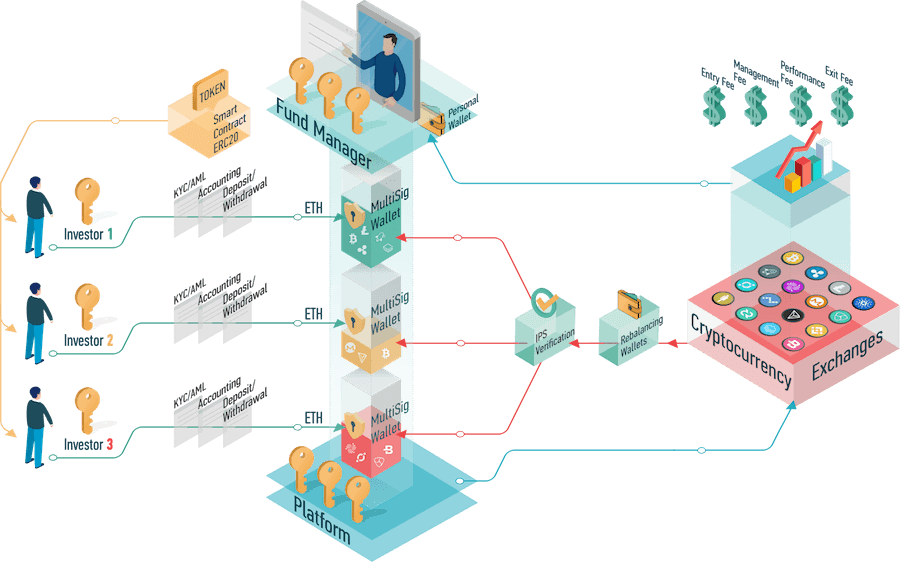

Asset Management. The asset management industry is poised to gain the most from current technological advances, as a number of its internal processes can be optimized with AI and blockchain technology – for example, portfolio rebalancing and risk management. This was the reasoning behind BAMP – Zichain’s innovative Blockchain Asset Management Platform. Funds using our turnkey solution will be able to spend less time on back office routine, instead allocating resources for development of trading strategy and portfolio management.