Crypto investment is nothing new, but CoinShares‘ recent launch of two flagship funds both designed to invest in a diverse range of cryptocurrencies, certainly is.

The two funds: ‘Active’ Fund – a multi-coin, alpha-generating, active strategy; and ‘Large Cap’ Fund – a passive basket fund; represent a natural evolution of market approaches based on the current trajectory of the crypto-asset economy.

CoinShares hopes to provide users with less volatility than other single purpose funds and also aims to provide more of a reward, without the higher risk some would assume to be in place.

Ryan Radloff, CEO of CoinShares suggested that this is the way forward for folks who are looking for a way to invest in cryptocurrencies. He said in a statement: “If you wanted to invest in the internet through a diverse mix of strategies focused on everything from servers, fiber-optics and silicon to search engines, social network start-ups and e-commerce infrastructure – this would be that fund; but for the crypto-economy.

“We are very excited about bringing this fund and Block Asset Management’s expertise to our investor base; both the strategy and team will be a great complement to CoinShares’ growing platform of strategies.”

The experience on the Block Asset team suggests this may be true, with their team holding experience from the likes of Credit Suisse, Societe General, Citibank, UBS, Barclays & Lloyds.

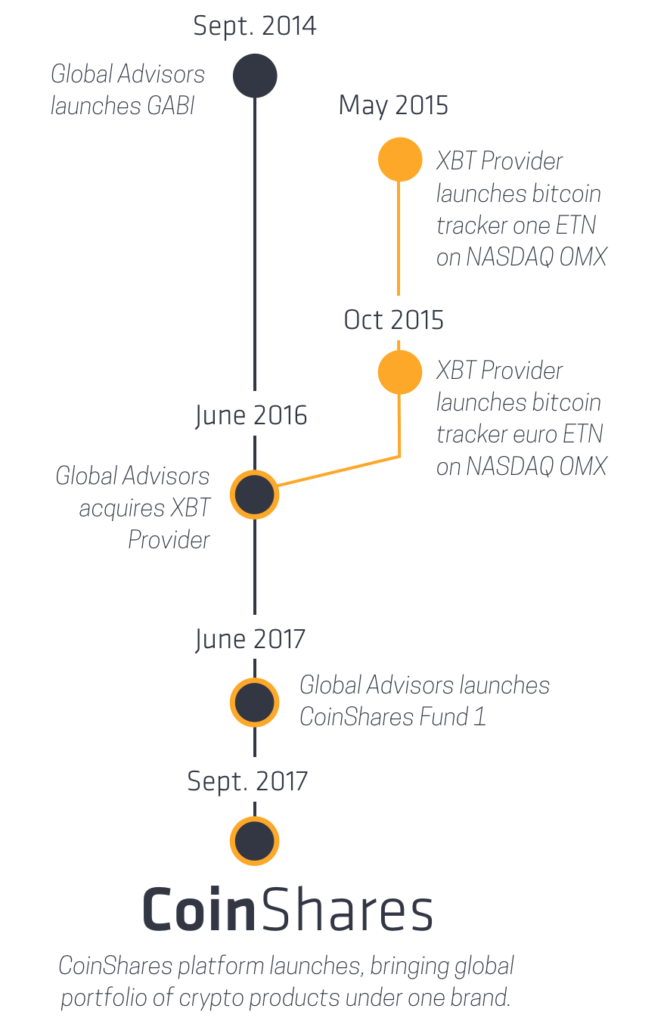

CoinShares are definitely hoping to take advantage of this market, as they have also announced that they would be introducing two other crypto asset funds just a month ago. Thus, it’s not surprising that they are the European leader in crypto-finance, holding over $1b in crypto-assets across their investment products.

This announcement follows the group’s October launch of the first Ether Tracking, Exchange Traded Products on Nasdaq Stockholm. These ETPs now comprise more than $350M of assets less than 4 months post launch.

Potential investors should take note however, that cryptocurrencies typically deal in a very volatile market. Thus, it is advised that investors should only invest if they can afford to do so, as their capital will be at risk and there is no guarantee of a return.

Launched just last week by Jersey-based financial firm

Launched just last week by Jersey-based financial firm  Jersey-based

Jersey-based