Indian police extorted builder for Bitcoin

Nine Indian police officers felt the full force of the law after being arrested for extorting nearly $50,000 in cash and 200 Bitcoins from Surat-based builder, Shailesh Bhatt, who claims he was kidnapped in a local hotel by the crime branch cops last February.

Read more here from NDTV.

Cardano scores with its launch on Huobi

Yesterday Huobi Pro announced that Cardano (ADA) will start trading on the 17th April at 14:00 GMT +8. Huobi is one of China’s largest cryptocurrency exchanges with a daily trading volume exceeding a billion dollars. The listing of the coin has already pushed the price up by 9.30% in the last 24 hours and is expected to significantly increase as more trading starts.

Coinbase acquires Earn.com for $100 million

Coinbase has acquired Earn.com for a cool $100 million. The firm was one of the most funded startups attracting $116 million over several rounds. CEO & Co-founder of Earn, Balaji Srinivasan, will become Coinbase’s first chief technology officer.

Read more here from Recode.

Tax day passing could help cryptos surge

Tax-selling has undoubtedly been a huge contributor to recent price dips but this could quickly reverse with the US tax deadline on the 17th of April predicted to be a day that cryptos increase.

Read more here from CNBC.

IMF boss says crypto could make finance safer

The head of the International Monetary Fund (IMF) – Christine Lagarde, believes digital currencies and blockchain technology could make the global finance system safer by increasing the speed, cost and safety of transactions.

That level of diversity could build a “financial ecosystem that is more efficient and potentially more robust in resisting threats”, she said.

Read more here from the Guardian.

Is your country a Bitcoin revolutionary?

Crypto enthusiasts across reddit are competing with each other in a challenge to prove which country is the most Bitcoin friendly. Users have posted Bitcoin signs spotted in stores across Romania, Saigon, Bali, Toronto and many more locations.

Read more here at The Next Web.

Honesty is the best policy?

An increasing numbers of ICO’s are promising all kinds of weird and wacky things from Bananas on the Blockchain (so ap-peel-ing) to AI that can predict the future. This week we seen the launch of Honest Coin “The Most Honest Cryptocurrency Ever Invented”. The project aims to be completely honest with their goals from day one.

Find out more here

Your ticket to the moon

No… we are not talking about psychedelics or bull markets however you can still ride yourself to the moon with CryptoRider, a mobile game developed to virtually ride those price charts. Now you can experience the highs and the lows again and again and again. Sounds like fun right? Download here.

Worlds first DNA on the Blockchain

A Los Angeles-bases cryptocurrency/ genetic firm has performed the worlds finda DNA sequence transfer on the Ethereum Blockchain. The Enterobacteria phage phiX174 sensu lato virus was transferred.

World’s first DNA sequence stored on the Blockchain

Is Monero the new tax haven?

Forget the Cayman Islands, Monero could be the next big tax shelter. With 8 months left of 2018 its time to become “tax efficient” by simply getting your boss to pay you in the pro privacy currency says hacked.com.

Indian crypto exchange offers bounty for information

Indian-based cryptocurrency exchange Coinsecure has offered a 10% bounty ($356,000) for information leading to the recovery of the $3(+) million funds stolen last week.

Read more here from India Times.

John Mcafee is Bullish on Bitcoin

Crypto personality John Mcafee believes that the Bitcoin price prediction of $20,000 in 2018 for Bitcoin is “absurdly low”. Agree or disagree we don’t recommend putting any body parts on the line.

Crypto-enthusiasts seek supportive Thai tax policy

In a bid to help domestic funding fro ICO’s and Cryptocurrency businesses in Thailand, enthusiasts have petitioned the Finance Ministry hoping the Revenue Department will reconsider its tax policy.

Read more here, the Bangkok Post.

Shipping on the Blockchain?

ShipChain is launching a pilot program this summer with CaseStack solving supply chain, tracking and tracing issues in the shipping industry. CaseStack works with Amazon, Target, Duracell and many other Fortune 50 companies in the world.

Read more here from Influencive.

Mastercard will tackle fraud with Blockchain technology

A patent has been filed by Mastercard that will use Blockchain technology to verify and store identity data to combat fraud.

Read the patent here filed at the United States Patent and Trademark Office.

Ethereum will power deep space exploration

The The University of Akron’s (UA) and NASA will work together to help spacecraft avoid floating debris, the assistant professor Dr. Jin Wei Kocsis has received $330,000 in the form of a grant from NASA.

Read more here from The University of Akron College of Engineering.

Not so illegal

The Foundation for Defense of Democracies released a report which found less then 1% of Bitcoin is used for illegal purposes.

Read more here from NewsBTC.

Insurance on the Blockchain

Marsh, ACORD Corporation and ISN Software Corp are working with IBM to develop insurance verification on the open-source hyperledger fabric technology and IBM blockchain platform. With the soft launch expected later this year. It will be used to speed up hiring contractors, transferring risk and coverage certainty.

Read more here from Seeking Alpha.

That all folks, until next time.

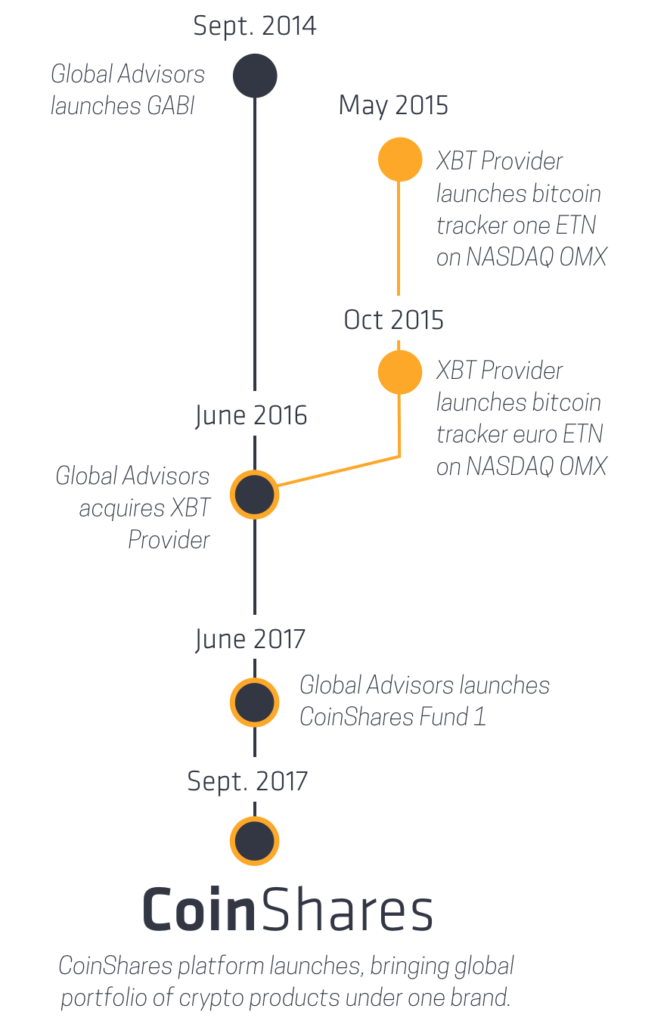

Launched just last week by Jersey-based financial firm

Launched just last week by Jersey-based financial firm  Jersey-based

Jersey-based