A leaked document(if legitimate) entitled “Crisis Strategy Draft” has surfaced across the internet confirming that troubled Bitcoin exchange Mt. Gox has entered serious financial problems.

It states that the exchange will shut its doors for one month as part of a four-step rebranding strategy, with CEO Mark Karpeles stepping down once a suitable replacement has been found.

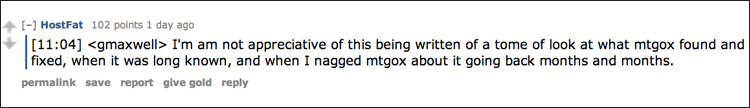

The exchange first entered muddy waters earlier this year when an alleged transaction bug in the Bitcoin source code caused havoc. It has only now become apparent that a massive 744,408 BTC with an estimated market value of $350 million has been skimmed by an unknown 3rd parties using this exploit. The company also has fiat liabilities of around $55 million. It’s worth noting that Mt. Gox was warned about the transaction bug, as revealed in our exclusive interview with Bitcoin developer Gregory Maxwell. They chose to ignore it which resulted in the “S**t hitting the fan”.

Although the leaked document appears genuine due to the apparent in depth financial knowledge of the exchanges current situation, it is yet unclear whether it has been internally leaked or drawn up by an external crisis management firm specialising in these type of situations.

On the face of things, Mt. Gox’s future does not look good, but one thing we do know is they they still have enough assets and liabilities to launch a new exchange as part of the four-step process as outlined.

Remaining assets and liabilities include:

- 2,000 BTC

- $22.4 million fiat

- 1.1 million user database

- High volume of trading

- Publicity in the worlds media

- Valuable domain names such as Bitcoins.com

- Physical Bitcoin cafe

- Japanese Bitcoin wallet software

The suggested four-step plan includes:

1. Reduce liabilities

The stakeholders of MtGox are not the owners, but everyone in Bitcoin. This is sad but the reality. The current situation will negatively affect everyone who owns or operates in Bitcoin. We will need to inject fresh coins inside the system in order to establish a basis to eventually clear the books by running the exchange (perhaps 200,000 coins). The costs of not doing so are incalculable at this stage.

Support from Bitcoin big players and core community – long term, high leverage:

Coins for equity, coin donations, and cash injections to buy coins at the cheap MtGox price are some options among many.

Bet on future profit to refill the lost coins – Long term, low leverage:

Regardless of malleability and regulatory issues, MtGox’s main problems are massive robbery and poor bitcoin accounting. However, the business as an exchange is highly profitable and healthy when run properly.

(Please refer to the business plan draft attached)

2. Shut down MtGox.com, launch new branding Big focus on the future

Letter from the CEO Admitting his errors and expressing desire to fix the situation by stepping back as a CEO. Blaming the technology implementation which was not sized and designed to deal with such level of transactions or to deal with malleability.

It’s time to step up and face reality by bringing a transition of respected advisors who will run things properly. In Japan, a CEO cannot resign until a new CEO is nominated. In that case customers knows that MtGox is still around and working, but under new management. Try to reduce the impact and raise stakeholder confidence, and eventually get Mark out. New branding, means that there are future-forward plans already in the works, and customers will see that MtGox actually has a plan in motion

3. 1 month transition while updating the industry

In order for stakeholders to follow up on MtGox progress, we will use SNS platforms with constant positive communications.

- Every new milestone reached will be announced: Team members, new marketing, progress on the technology implementation etc…

- The Customer support will stay operational to deal with people who want to have access to their account/history

- During this period, the advisory board will be created, hopefully a new CEO can be chosen and try to reset and secure the trading engine platform. Expertise to find: Analysts, top class developers (crypto), IT security expert, marketing, Bitcoin experts, economists, execs (CFO, COO, CMO, etc)

4. MtGox becomes Gox

To avoid a bank run from customers, the daily amount of bitcoin and cash withdrawals will be limited. With the profit, a meticulous analysis will be made over the coming years to clean the bitcoin balance sheet while running the exchange and generating revenue to pay back stakeholders.

New offerings such as additional currencies, low trading fees, etc will give customers a reason to stay with MtGox.

The new branding is already complete, and new services such as the Bitpocket wallet are already developed and ready for deployment.

With a new image, team, and offering we believe that it will be a challenge, but is not impossible. The risks of not acting are incredibly large and unpredictable.