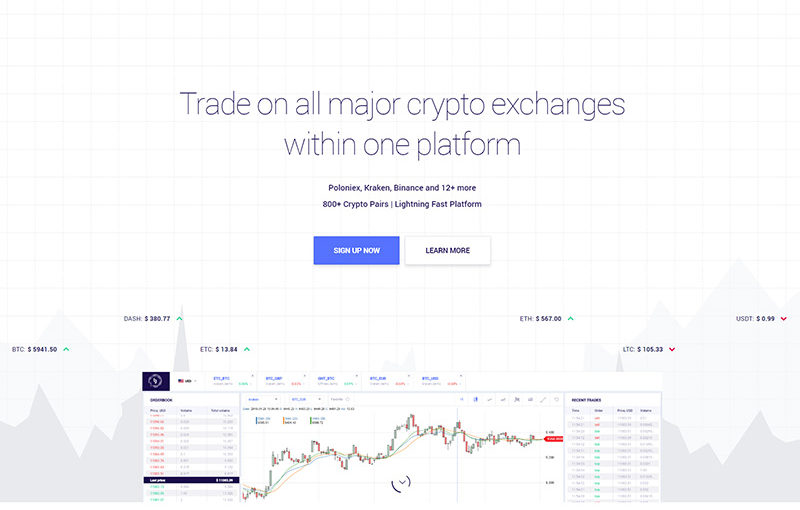

Exenium has just started their ITO campaign, offering excellent benefits for the early investors. This is the world’s first fully functional cryptocurrency exchange that has been implemented as a chatbot for the most popular messengers, including Telegram, WhatsApp, Facebook Messenger, and Discord.

Feb 10, 2018

Exenium is delighted to announce that their Initial Token Offering has just gone live. A multiplatform cryptocurrency exchange for the sale and purchase of cryptocurrency, this platform comes with a comprehensive set of tools for multi-currency investor portfolio management. The creators claim that in Exenium, they have built the world’s first ever chatbot trading platform that supports messengers such as Telegram, WhatsApp, Facebook Messenger, and Discord. The just launched ITO provides an excellent opportunity to acquire the exchange’s liquidity guaranteed promotional token called XNT.

Exenium was created with the goal of delivering a service that will solve all the complex requirements of today’s volatile cryptocurrency market. Though there has been huge buzz about ICOs in the recent times, during the crowdsale stage, almost 85% of these projects lack a minimum viable product. Moreover, with new cryptocurrencies hitting the market every now and then, almost 99% of the tokens experience a price drop because of an excessively high supply and low demand. Exenium looks to solve this crisis by creating an ecosystem where all the spent tokens will be withdrawn from circulation. This mechanism will not only increase the token’s capitalization, but also influence the token price throughout its circulation phase.

Most of today’s cryptocurrency exchanges are also crippled by difficulties such as DDos attacks and unstable service, hacker attacks and insider leaks, steep learning curves, poor or no customer support, and issues related to regulatory policies. Interestingly, Exenium has done well to come up with a solution for each of these problems.

- Exenium is capable of withstanding DDoS attacks of any length and process up to ten thousand order creation requests per second, with an unlimited amount of simultaneously connected users.

- The platform has successfully passed a rigorous stress testing process for the security of the servers.

- With an intuitive and easy to use interface, Exenium allows users the freedom to choose the instant messenger of their preference to work with the exchange interface.

- 24/7 technical support for each customer inquiry directly through the messenger chosen by the user.

- Fully compliant with the AML and KYC requirements imposed by exchange regulators.

“In order to hack Exenium, one will first have to hack the core of Telegram / Facebook Messenger / WhatsApp etc. and then identify the IP of our bot. Our bot sends requests to the messenger every second, requesting whether it is still working,” explains a senior member of the Exenium team. “If there is no signal, it stops working and our core changes the IP address of the bot. Therefore, finding the IP address of Exenium core is an extremely difficult job. Exenium core works only with whitelist IPs, and there is some more security levels that we would not like to disclose at this stage.”

Exenium platform comprises of several key modules as mentioned below.

- Wallet: Allows users to hold cryptocurrency and fiat, and transfer to others within the exchange as well as directly to the messenger account.

- Trading: Allows creating orders and exchanging currencies.

- Affiliate Program: Provides access to a personal referral link with the ability to track partner rewards.

- ICO/ITO: Offers tools for conducting Initial Token Offerings for the exchange and various other utility tokens. The listing of tokens is cheap and quick without any bureaucratic interference.

- Investment Management System: Provides a toolset for investment funds to manage multi-currency portfolios.

- Statistics: Data support to keep track of funds in deposit accounts, number of open and closed orders, trading volume for each currency pair, and Top-5 best tickers.

- Verification: Helps ensure AML and KYC compliance.

- Payment System: Provides fiat gateway.

All services available on Exenium can be paid using Exenium’s own token named XNT. While making any payment with XNT, there will be an addition of 5% of its exchange rate value as discount. The XNT digital token will be released on the Ethereum platform, as per the ERC20 standard. The token contract will be released after the ITO, when the emission quantity will be established.

More about Exenium and their ongoing ITO campaign can be found at https://exenium.io/

About Exenium: Exenium is a fully functional cryptocurrency exchange implemented as a chatbot for Telegram and other popular messengers. It has all the features of traditional exchanges, such as wallets, fiat and cryptocurrency funding, KYC verification and others, wrapped in a quick and intuitive interface. It uses powerful servers to ensure stability, handling up to 10,000 simultaneous order submissions.

Contact:

Alexander Korzhanov

Website: https://exenium.io/

Email: [email protected]