he Covesting project captured ample media attention since it was announced by Dmitrij Pruglo, as it is the first of its kind, copy-trading platform for crypto currencies.

What Covesting Platform Offers

Covesting allows less-versed cryptocurrency investors to automatically copy the trades of the expert traders on the platform, thus increasing their chances to make profit from the trades. In return, the expert traders get 18% of the profits made by followers copying his trade, and Covesting takes 10% towards facilitation. Considering that Covesting charges an additional 2% of the total deposited amount, the investor still makes over 70% of the original profit without getting involved in the actual trading.

Mr Dmitrij Pruglo, the CEO spoke to the media and said, “it’s a very exciting moment for us as we go into the pre-ICO stage. We have worked hard for this and we are looking forward to a very positive response from the market. The market is vastly centralized which is why it is plagued with perennial issues like opacity, scams, unethical deals and often, immoral and illegal deals. With decentralization and blockchain, we are here to erase those problems and connect the investor to the trader, for direct profit sharing.”

Exclusive Advantages of Covesting pre-ICO sale

In order to develop the platform within shortest period of time, Covesting team has decided to go for Initial Coin Offering (ICO). Covesting pre-ICO is followed quickly by the ICO which runs from November 24 to December 23, 2017. However, the pre-ICO deal is much better than the ICO offer. Some of the exclusive advantages of the pre-ICO deal are

- Discounted Rate: COV prices are kept 300 COV for 1 ETH which is more than 70% discount compared to the final stage ICO rate of 130 COV for 1 ETH. Even if we compare it against the best rate during the ICO, which is 200 COV for 1 ETH, this is a 50% more than that. This makes the pre-ICO particularly enticing.

- Limited Coins: Unlike many other coins where as much as 20% coins are available during the pre-sale, Covesting is bringing only 7.5% coins to the market during this phase. Why is this good for the early investor? Because, not many investors can get these coins at that rate and that pulls up the actual value of the early investor’s coins up.

- Low investment: Some ICOs want as much as 50 ETH as minimum purchase during pre-ICO, Covesting wants only 0.1 ETH (30-32 USD) as the minimum investment. Thus, Covesting is perfect even for the smaller investors.

- Profitability: As soon as the platform goes live in 2018 the price of the COV coins is expected to go up as more traders, experts and investors join the bandwagon, thus, creating a higher demand for these coins.

Covesting provides exceptional opportunity to take part in the token crowdsale and benefit from the platform growth by purchasing Covesting Tokens prior to the beta-version launch of the copy-trading system.

Intependently rated ICO. Growing team of professionals.

The ICO has already gone through a third-party audit, where ICO Bench rated Covesting a 4.7/5.0 which is much higher if compared with its peers. The Covesting team has also added four additional advisors in the past week to the project. Vlad Dobrov, an entrepreneur and ICO advisor based in New Zealand with 19 years of financial industry experience; Mounir Fallah, the Executive Director at FXQuantum who has 12 years in brokerage and asset management experience based in the United Arab Emirates; Ivan Klykov, CEO of Invest Idei and an ex-head portfolio manager from Russia; and Andrey Gromak a director at Barings Private Finance have all joined the team to assist with functionality and feature development on the Covesting platform.

Covesting pre-ICO Details

- Coin Name: COV

- Coins available in pre-ICO: 1,500,000 (7.5% of total coins)

- pre-ICO date: 20th Oct 2017 – 19th Nov 2017

- Price: 1 ETH = 300 COV

- Target: 5000 ETH

Pre-ICO shall be executed on first-come, first-served basis, therefore availability of tokens can’t be guaranteed for all interested participants.

Learn more about Covesting: https://covesting.io

Covesting whitepaper: https://covesting.io/Covesting_White_Paper.pdf

Follow Covesting on Facebook at: https://www.facebook.com/covesting

Follow Covesting on Twitter: https://twitter.com/covesting

Join Covesting Telegram channel at https://t.me/covesting

Website: www.covesting.io

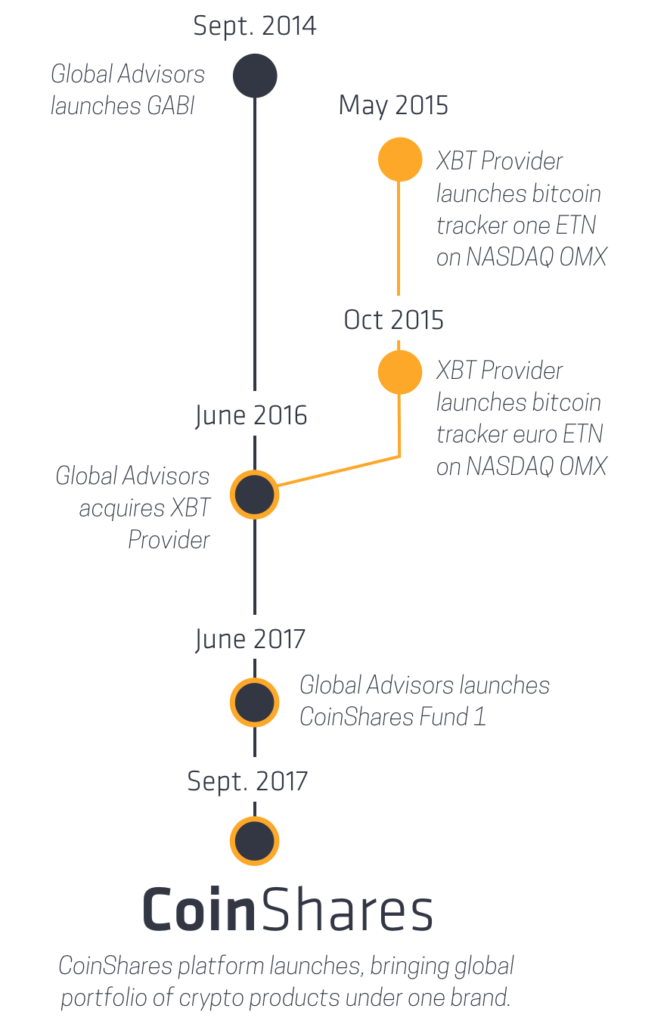

Launched just last week by Jersey-based financial firm

Launched just last week by Jersey-based financial firm

Ottignies-Louvain-la-Neuve, Belgium – The world’s first

Ottignies-Louvain-la-Neuve, Belgium – The world’s first

Jersey-based

Jersey-based